Arthalok

Get Paid for Taking Loans from any Banks!

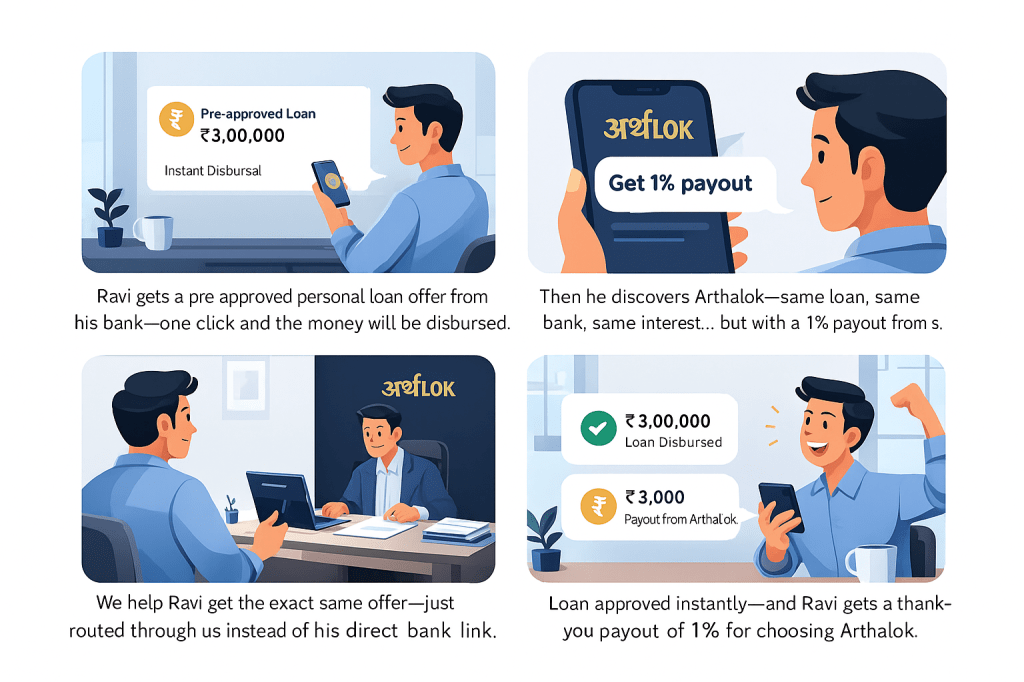

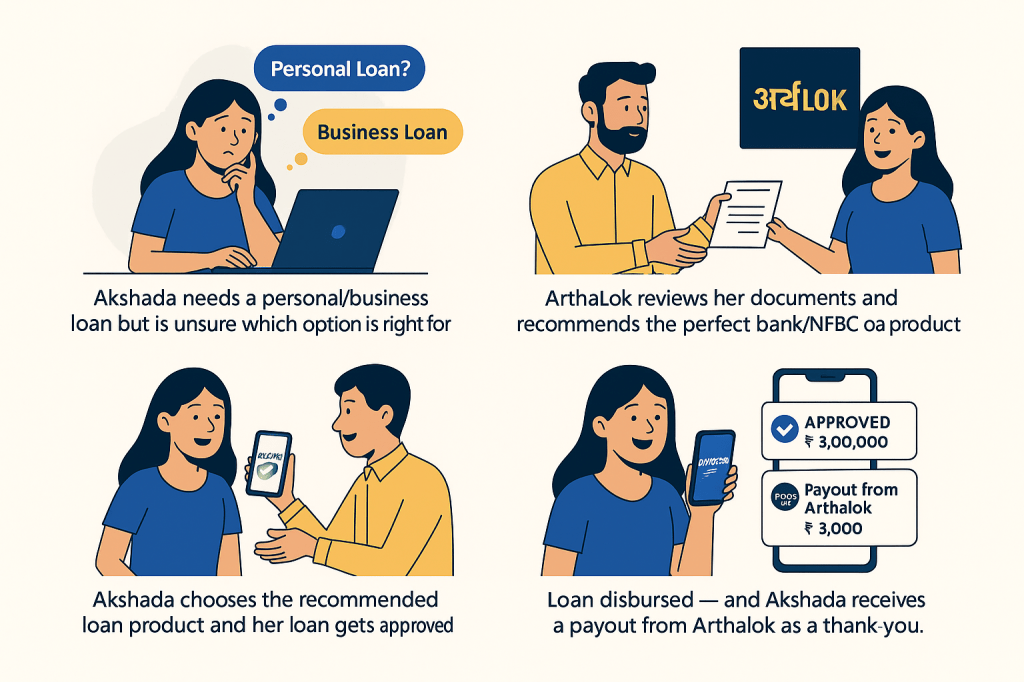

At Arthalok, we’re not just your loan facilitators—we’re your partners in getting the best deal. We promise to find you the most favorable loan rates and terms from top banks in the shortest time possible. And as a thank you for choosing us, we give you 1% of your loan amount back after your loan is disbursed. With Arthalok, you get a little extra in your pocket and a lot more peace of mind. Even if you have a pre approved loan or if you are trying to figure out the best option or if you are getting rejected from certain banks, Arthalok helps you sail through!

Ravi Almost Missed His Payout — Until Arthalok!

How Arthalok Found the Right Lender for Akshada?

Enquire Now for Loan

Thank you! Our team will reach out to you shortly.

Frequently Asked Questions

Personal Loan – Salaried

What documents are required for salaried personal loan?

• Last 3 months salary slips

• Last 3–6 months bank statements (salary credit proof)

• Aadhaar + PAN

• Current address proof

• Employee ID card (if available)

• Form 16 (sometimes required)

• Last 3–6 months bank statements (salary credit proof)

• Aadhaar + PAN

• Current address proof

• Employee ID card (if available)

• Form 16 (sometimes required)

What is the minimum salary required?

It varies by bank/NBFC, but most lenders require ₹15,000–₹25,000 net take-home salary.

Can I apply if my company is not listed?

Yes — many lenders support unlisted companies. Eligibility depends on salary credit, bureau score and stability.

Do I need to provide collateral?

No. Salaried personal loans are unsecured, so typically no collateral is required.

Personal Loan – Self-Employed

What documents are required for self-employed individuals?

• Last 2–3 years ITR

• Current year financials (P&L, Balance Sheet)

• Bank statements (6–12 months)

• GST returns (if registered)

• Business proof (GST Registration / Shop Act / Partnership Deed)

• PAN + Aadhaar

• Office address proof

• Current year financials (P&L, Balance Sheet)

• Bank statements (6–12 months)

• GST returns (if registered)

• Business proof (GST Registration / Shop Act / Partnership Deed)

• PAN + Aadhaar

• Office address proof

Is ITR mandatory?

Most lenders ask for 2 years ITR. Some NBFCs accept bank-statement-based income if ITRs are not available.

Can I get a loan with low income?

NBFCs sometimes lend based on average monthly credits even when taxable income is low.

Business Loan – Self-Employed

What documents are required for a business loan?

• ITR (2–3 years)

• GST returns (12 months)

• Bank statements (6–12 months)

• Business registration (GST Registration / Shop Act / Incorporation)

• Business address proof

• KYC – PAN, Aadhaar

• Partnership deed / MOA/AOA (if applicable)

• Stock & purchase invoices (if required)

• GST returns (12 months)

• Bank statements (6–12 months)

• Business registration (GST Registration / Shop Act / Incorporation)

• Business address proof

• KYC – PAN, Aadhaar

• Partnership deed / MOA/AOA (if applicable)

• Stock & purchase invoices (if required)

Is collateral required for a business loan?

Not always. Unsecured options exist for smaller amounts; secured loans need property or assets.

Can a new business apply?

Most lenders ask for 12+ months vintage; some startup-focused NBFCs accept newer businesses.

General FAQs

What is Arthalok?

Arthalok helps customers find the best loan options from banks & NBFCs — we compare products, guide on documents and assist through approval.

Why do you give a payout?

You receive **1% payout** after loan disbursement as a thank-you for choosing Arthalok. Arthalok gets paid by the Bank/NBFC for getting them business and a part of it is given back to the customer. Your loan amount, interest rate, and bank remain the same if you have a preapproved Loan offer, else you will get the best deal possible (No fake promises).

How long does it take to get a loan approved?

• Pre-approved: Instant

• Salaried personal loans: 2–6 hours

• Self-employed/business: 24–72 hours (typical)

• Salaried personal loans: 2–6 hours

• Self-employed/business: 24–72 hours (typical)

Do you charge any fees?

No — we don’t charge customers. Lenders pay us and we share a portion as the payout.